The EU European Market Infrastructure Regulation (EMIR) on OTC derivatives, central counterparties and trade repositories aims to reduce systemic risk and improve transparency in respect of OTC derivatives markets. It was originally introduced in response to G20 commitments to regulate OTC derivatives markets in the aftermath of the financial crisis.

Key aspects of EMIR include:

- a mandatory clearing obligation for certain classes of OTC derivatives contracts entered into between certain counterparties;

- risk-mitigation requirements for OTC derivatives hat are not centrally cleared (including margin requirements);

- trade reporting obligations for all derivatives (both OTC and exchange-traded derivatives); and

- a framework for the regulation of central counterparties (CCPs) and trade repositories (TRs).

EMIR has been amended by Regulation (EU) No 2019/934 (EMIR Refit), which entered into force on 17 June 2019. EMIR Refit introduces targeted amendments to EMIR which aim to simplify and take a more proportionate approach to certain existing requirements. Key changes introduced under EMIR Refit include introduction of:

- a clearing threshold for small financial counterparties (Small FCs) and application of the clearing threshold for non-financial counterparties

(NFCs) on an asset class by asset class basis

- powers for ESMA to request that the European Commission suspends the clearing obligation in certain circumstances

- changes to reporting requirements, including requirements for FCs to report OTC derivative transactions on behalf of NFC- counterparties

- requirements for clearing members to provide services on fair, reasonable, non-discriminatory and transparent terms (FRANDT).

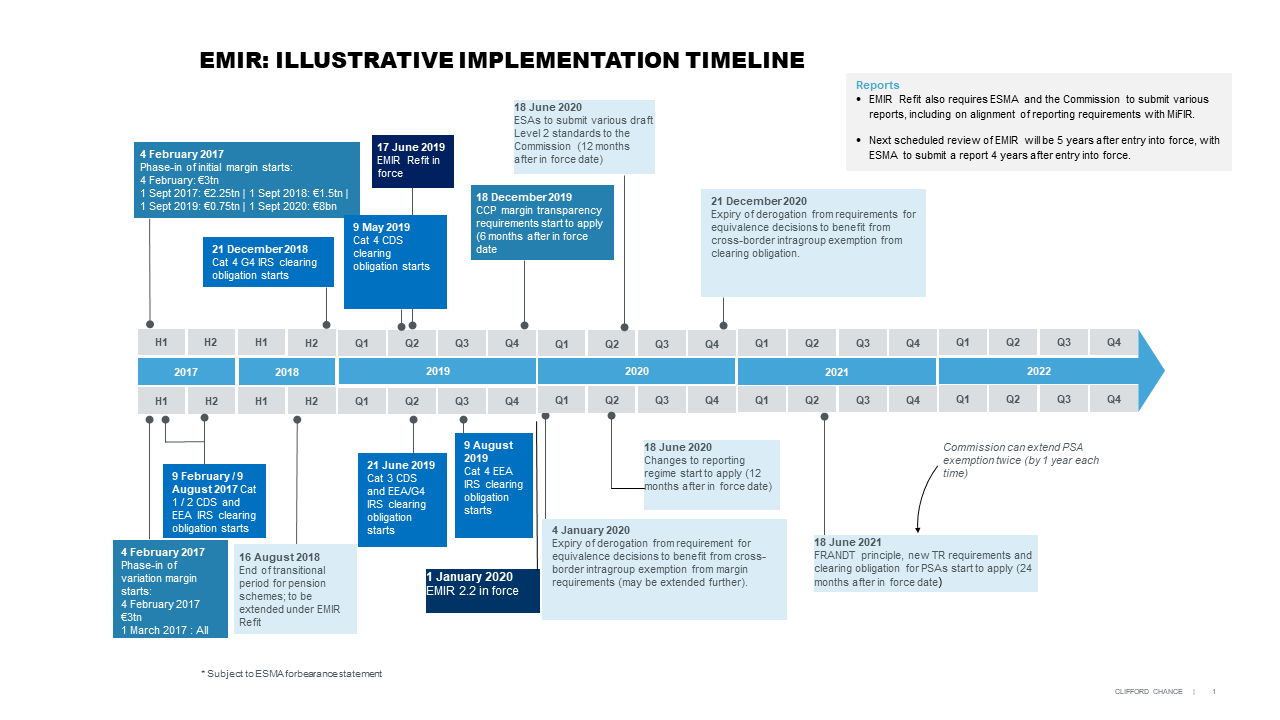

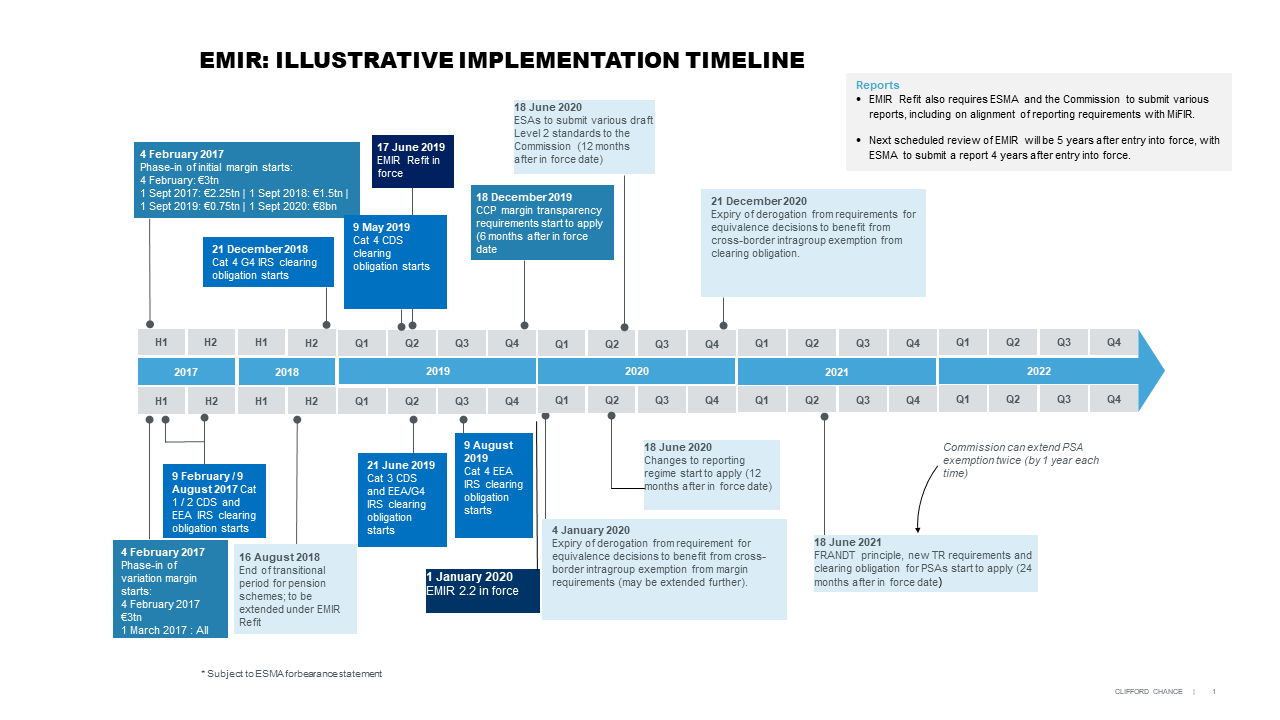

Some of these requirements will start to apply 6, 12 or 24 months after EMIR Refit entered into force, as summarised in the table below and in the EMIR Refit overview client briefing.

Alongside the EMIR Refit amendments, the EU co-legislators have also agreed amendments to the provisions of EMIR relating to CCP supervision (EMIR 2.2). The amendments aim to strengthen the supervision of CCPs in order to take into account the growing size, complexity and cross-border dimension of clearing in Europe. EMIR 2.2 establishes a CCP supervisory committee within ESMA, which will bring together supervisory authorities from relevant Member States as well as central banks responsible for the EU currencies cleared by CCPs. It also changes the existing system for recognition of non-EU CCPs, distinguishing between non-systemically important CCPs which will continue to be subject to the current regime, and systemically important CCPs ("Tier 2" CCPs) which will be subject to stricter rules. A non-EU CCP may also be required to establish a presence in the EU if ESMA and the Commission decide (as a measure of last resort) that the CCP is so systemically important that it cannot be appropriately supervised under the recognition regime. EMIR 2.2 entered into force on 1 January 2020.

Several EMIR obligations are implemented through Level 2 measures (Commission delegated acts and regulatory and implementing technical standards (RTS and ITS)) see "Final Level 2 material" tab below.

Status

Level 1: EMIR published in the Official Journal on 27 July 2012 and came into force on 16 August 2012. Article 89(1) of EMIR amended by Commission Delegated Regulation 2017/610 of 20 December 2016 in order to extend exemption from Article 4 clearing obligation for pensions schemes until August 2018. The EU regulation on securities financing transactions (SFTR) published in the Official Journal on 23 December 2015 and in force 12 January 2016 amends the definition of OTC derivatives in EMIR and creates a new procedure for assessing the equivalence of non-EU markets.

There have been various amendments to EMIR, the most recent have been made by EMIR 3.0. See the EMIR Q&As under Official Correspondence section.

Level 2: Regulatory Technical Standards for G4 rates clearing obligation published on 1 December 2015 and came in to force on 21 December 2015. RTS for CDS clearing obligation published on 19 April 2016 and entered into force on 9 May 2016. Regulatory Technical Standards on margin for uncleared derivatives published on 15 December 2015 and entered into force on 4 January 2017. Phase 1 IM and VM and Phase 2 VM are in force. The Phase 3, 4, and 5 application dates for IM are 1 September 2018, 1 September 2019 and 1 September 2020 respectively. For all IM and VM phase-in dates see the Margin for Uncleared Derivatives Toolkit page.

Clearing obligation start dates and frontloading periods phased in for different counterparty categories:

| |

G4 rates clearing obligation starts |

CDS clearing obligation starts |

EEA clearing obligation starts |

Category 1 firms

|

21 June 2016

|

9 February 2017

|

9 February 2017 |

Category 2 firms

|

21 December 2016

|

9 August 2017

|

9 August 2017 |

Category 3 firms

|

21 June 2019

|

21 June 2019

|

21 June 2019 |

Category 4 firms

|

21 December 2018

|

9 May 2019

|

9 August 2019 |

*Calculation dates for determining Category 2 status for G4 Rates CDS RTS and EEA rates are end of January 2016, February 2016 and March 2016). Following a report by ESMA (November 2016), on 16 March 2017, the Commission adopted amendments to the RTS delaying the application of the compliance dates for Category 3 firms for G4 rates, CDS RTS and EEA rates until 21 June 2019. The RTS were published in the Official Journal on 29 April 2017 and came into force on 19 May 2017. ESMA has also provided Q&A guidance on when firms are expected to start clearing transactions under EMIR and EMIR Refit, depending on their categorisation and whether or not they have calculated that they fall above or below a relevant clearing threshold.

ESMA has recognised CCPs in several jurisdictions including Australia, Canada, Hong Kong, Japan, Mexico, Singapore South Africa, Switzerland, and the United States.

Commission Delegated Regulation (EU) 2023/315 published on 13 February 2023 contains RTS extending a grace period during which firms could benefit from an intragroup exemption from the clearing obligation for cross-border transactions without the need for an equivalence decision for the non-EU jurisdiction to 30 June 2025. Commission Delegated Regulation (EU) 2023/314 also published on 13 February 2023 contains RTS also extending a similar time-limited derogation from margining requirements for non-cleared OTC derivatives to 30 June 2025. Firms will be operating under a regulatory forbearance statement until the RTS are published in the Official Journal and come into force.

Next

Further equivalence decisions with respect to CCPs in additional jurisdictions and the recognition of additional non-EU CCPS under EMIR are expected.

In December 2017 the Joint Committee of the ESAs published draft RTS amending EMIR with regard to physically settled FX forwards. In the ESAs' December 2019 Final Report on RTS on amendments to the bilateral margin requirements in view of the international framework, it was confirmed that the draft amendment submitted by the ESAs in December 2017 would be replaced by a new amendment covering a broader scope, i.e. not only covering physically settled FX forwards, but covering both physically settled FX forwards and swaps, with the same exemption for both, as such amendment is contained in the draft RTS of December 2019.

National implementation

EMIR has direct effect. However, it requires changes to some Member State legislation. For example, there have been amendments to the UK legislation, rules and regulations in connection with EMIR.

EMIR REFIT

On 28 May 2019 Regulation (EU) 2019/834 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivative contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories was published in the Official Journal. The Regulation entered into force on 17 June 2019 and applied from the date of entry into force except for:

- provisions set out in points (10) and (11) of Article 1 as regards Articles 38(6) and (7) and 39(11) of EMIR, which applied from 18 December 2019;

- provisions set out in point (7)(b) of Article 1 as regards Article 9(1a) to (1d) of EMIR, which applied from 18 June 2020; and

- provisions set out in points (2)(b) and (20) of Article 1 as regards Articles 4(3a) and 78(9) and (10) of EMIR, which applied from 18 June 2021.

EMIR 2.2

On 12 December 2019 Regulation (EU) 2019/2099 as regards the procedures and authorities involved for the authorisation of CCPs and requirements for the recognition of this country CCPs was published in the Official Journal. The Regulation entered into force on 1 January 2020.

Brexit contingency planning:

For further details see the section on Brexit contingency planning.