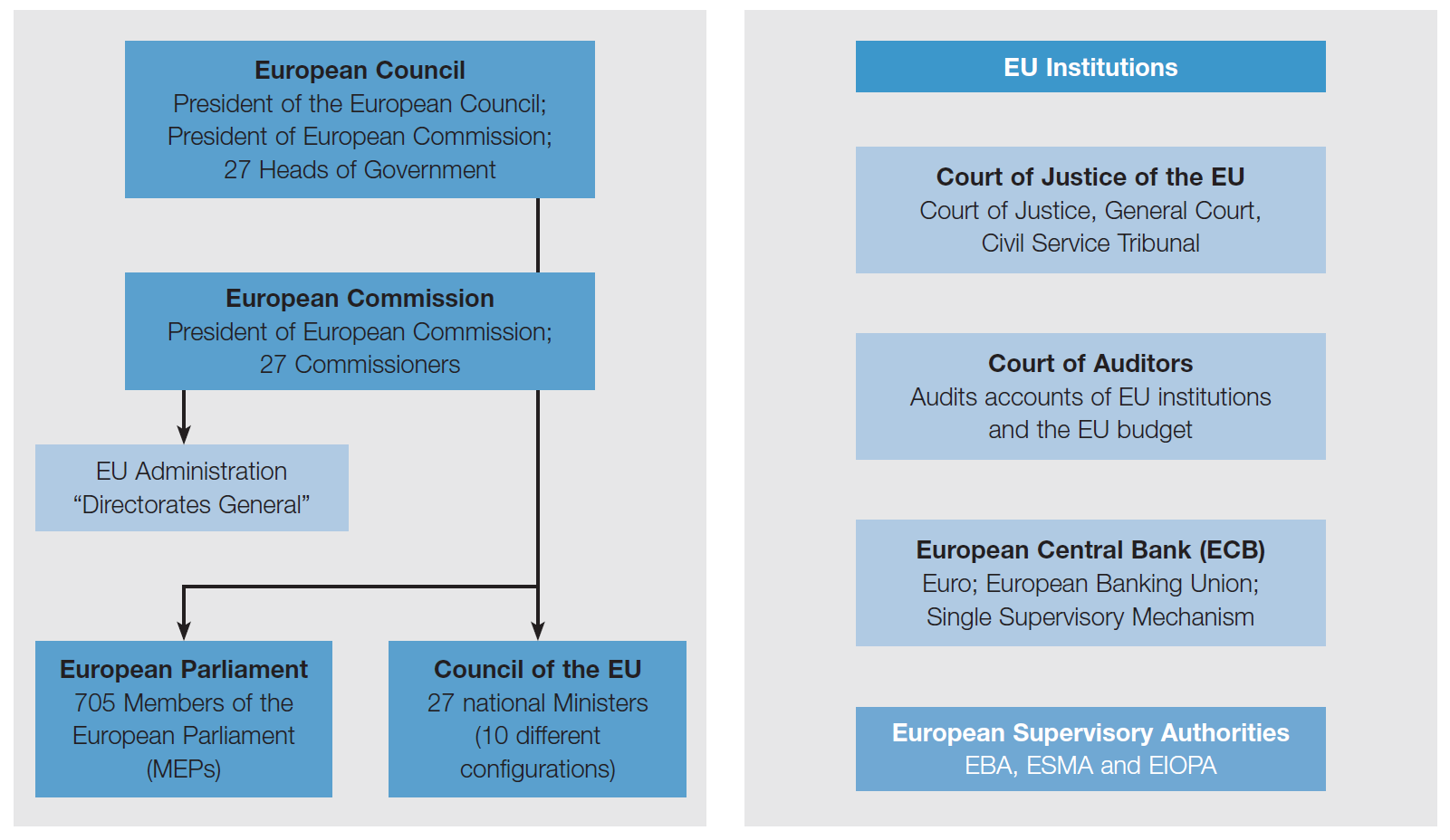

The European Union (EU) is the name given to the formal association of 27 European countries, or Member States, and is used to describe the geographical area covered by those countries as well as the abstract concept of the association. The establishment and operation of the EU is based on intergovernmental treaties by means of which the Member States have granted certain powers and functions to centralised EU institutions, of which the most important are the European Commission, the Council, the European Parliament and the European Court of Justice. The distribution of power both between EU institutions and Member State governments and amongst the institutions themselves is still shifting and is the subject of continuing debate.

Key institutions

The European Commission

The European Commission is the central administrative and policy-making body of the EU. It is made up of 27 Commissioners (nominated by the Member States and approved by the European Parliament), one of whom acts as President. The Commission formulates legislative proposals, implements Council decisions, negotiates international agreements on behalf of the EU and supervises compliance with, and implementation of, EU law by the Member States.

The Council of the European Union

The Council of the European Union (or Council of Ministers) is the EU’s principal decision-making body. At the top level it comprises government ministers or state secretaries of all the Member States with responsibility for a particular sector, e.g. finance ministers will convene to discuss proposed legislation on financial services in the configuration of the Council known as the Economic and Financial Affairs Council (Ecofin). The details of legislation are usually worked out at lower levels by other official representatives of the Member States, the most important of these being the Committee of Permanent Representatives (Coreper). The European Council, a twice-yearly meeting of the Heads of State or Government of the Member States, reviews and decides on the overall policy of the EU.

The European Parliament

The European Parliament is a democratically elected body with members (MEPs) elected directly from each of the Member States and grouped according to political, rather than national, affiliation. The number of MEPs from each Member State is roughly proportionate to the Member State’s population. It shares with the Council the power to legislate and it exercises democratic supervision over the Commission. Other EU bodies such as the Economic and Social Committee, the Committee of the Regions and the European Central Bank (ECB) may also play an advisory role in the legislative process.

The European Court of Justice is a supranational court, which is responsible for interpreting and enforcing EU law.

European Central Bank

The EU Treaties provide for the euro to be the common currency of the Member States participating in monetary union. Currently, 20 Member States are members of the eurozone. The ECB sets the monetary policy for the eurozone and an informal body of ministers of the euro area Member States (the Eurogroup) coordinates economic policies among those states, supported by the European Commission. The ECB also performs other specific tasks in relation to banking supervision, banknotes, statistics, macroprudential policy and financial stability as well as international and European cooperation.

European Supervisory Authorities

In the context of financial services, the EU has created three specialised European Supervisory Authorities (ESAs): the European Banking Authority (EBA), the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA). The ESAs have a limited quasi-rule making power, have some direct supervisory responsibilities (e.g. ESMA directly supervises credit rating agencies) and are responsible for coordinating the consistent application of EU law by the competent authorities and mediating between them.

The European Systemic Risk Board (ESRB) is the macro-prudential supervisor created as part of the creation of the European System of Financial Supervision. See the "European System of Financial Supervision" section of this Topic Guide.

The Member States play a role, through the Council, in developing EU legislation and are responsible for ensuring that EU legislation is implemented and applied in their territories. EU legislation may require Member States to designate "competent authorities" (e.g. national supervisors) to implement or supervise the implementation of provisions of EU legislation.

The ECB and the Single Resolution Board (SRB) respectively perform banking supervision and bank resolution functions in relation to banks in the eurozone and other Member States participating in the Banking Union (in conjunction with national competent authorities). New legislation will also establish an EU authority with quasi-rule making powers and other functions relating to the supervision of anti-money laundering and countering terrorist financing AML/CTF in the financial and non-financial sector similar to those of the ESAs.

.PNG)

* All eurozone Member States and other Member States that have established close cooperation arrangements with the ECB participate in the EU's Banking Union. Croatia and Bulgaria joined as participants in the Banking Union on 1 October 2020. Croatia joined the eurozone and became a full member of the Banking Union on 1 January 2023.

† Russia ceased to be a member of the Council of Europe in March 2022.

‡The UK ceased to be an EU Member State on 31 January 2020.

EU legislation

The EU can only legislate in areas in which there is specific authority to do so in one of the EU Treaties. In the area of financial services, legislation will normally be based on the provisions of the Treaties giving the EU power to legislate to develop the single market. The Treaties and legislation made under the Treaties take precedence over any inconsistent national law.

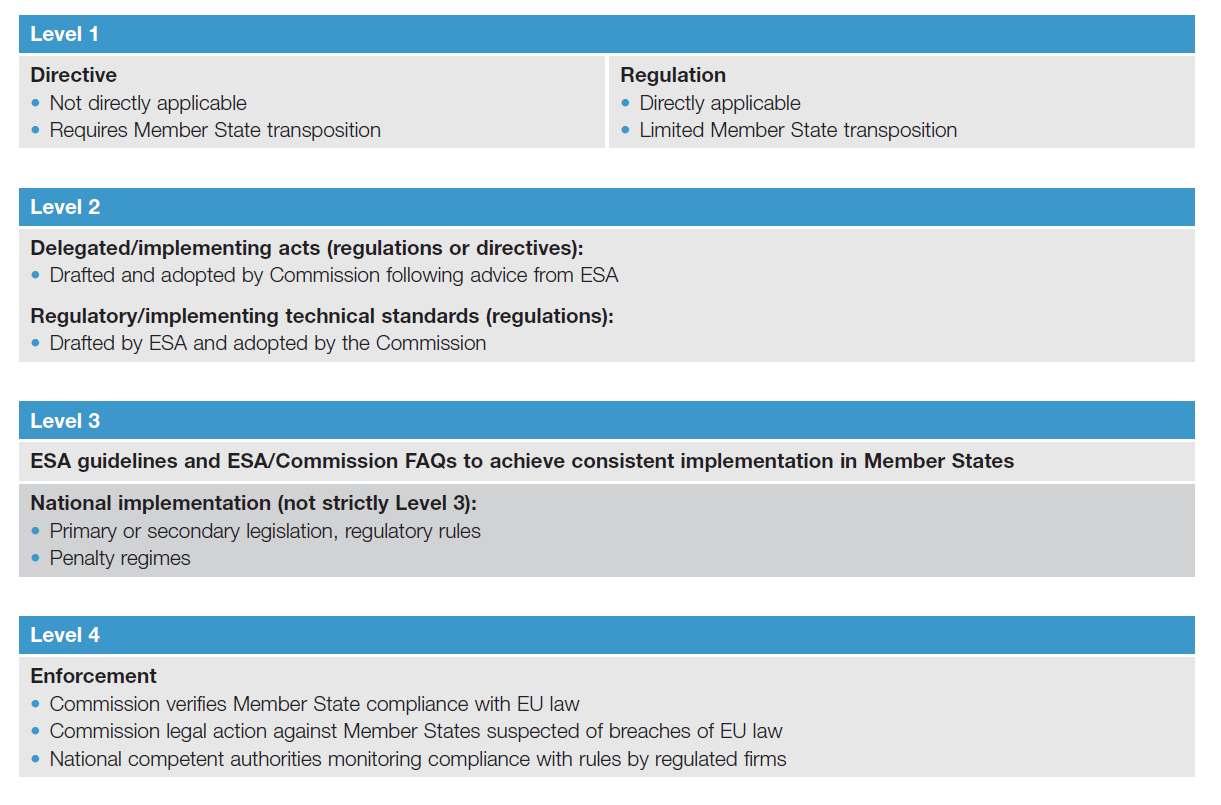

Legislation may take the form of Regulations or Directives. Regulations are directly applicable (i.e. they have a binding legal effect) in all Member States. By contrast, Directives are not directly applicable and they need to be implemented into national law by the law-making bodies of each Member State. In addition, the EU Treaties or legislation made under them may give the Commission or other bodies powers to adopt decisions or recommendations on particular issues.

Legislative process

The Commission initiates most EU legislation although it does not enjoy a monopoly on the "right of initiative". In certain circumstances the ECB, the European Investment Bank or the European Parliament can play a role in the initiation or adoption of EU legislation. Also, in forming its legislative programme the Commission needs to take into account the political wishes of the Member States (expressed through the Council) and the European Parliament.

Once the Commission issues a legislative proposal it is considered by the Parliament and the Council and will follow one of a number of procedures as dictated by the Treaties. The most commonly used of these is the ordinary legislative procedure (formerly known as codecision). Under the ordinary legislative procedure, the Parliament and the Council are the co-legislators and both need to agree on the legislation. See the "EU Legislative Process – Level 1" section of this topic guide.

EU legislation may confer on the Commission the power to adopt delegated or implementing acts on the conditions that are set out in the legislation. Delegated acts supplement or amend non-essential elements of the legislation. Implementing acts are used to ensure the uniform conditions for implementing Regulations or Directives. Delegated and implementing acts may take the form of Regulations, Directives or, in some cases, decisions adopted by the Commission. The legislation conferring the powers on the Commission to adopt delegated and implementing acts will specify the conditions under which that power can be used. See the "EU legislative process – Level 2" section of this topic guide.

Lamfalussy process for financial services regulation

In the financial services sector, new laws and rules are developed according to the "Lamfalussy Process" (named after the chair of the EU advisory committee that originally outlined the process in its final report in 2001). This process has evolved following the establishment of the European System of Financial Supervision and the creation of the ESAs, in particular after the de Larosière report in 2009, with the aim of creating a harmonised core set of standards (a "single rulebook") for the financial sector.

Under this four level process, "Level 1" framework legislation establishes the broad base of new rules. This legislation is usually adopted by the Parliament and the Council under the ordinary legislative procedure. There is a political preference for new Level 1 legislation to take the form of Regulations to enhance the uniformity of the single rulebook for financial services, but legislation may take the form of Directives (or, in some cases, a companion Directive and Regulation). The ESAs then work in conjunction with the Commission to develop the "Level 2" measures through which framework legislation is implemented. The Level 1 legislation will specify the powers of the Commission to adopt Level 2 measures which may take the form of:

- Delegated or implementing acts adopted by the Commission, usually after taking the advice of one or more of the ESAs. These may take the form of Regulations, Directives or decisions.

- Regulatory Technical Standards (RTS) or Implementing Technical Standards (ITS) which are delegated or implementing acts where the Level 1 legislation confers on one or more ESAs the power (or the duty) to draft the relevant act and to submit it to the Commission for adoption according to the procedure set out in the Regulations establishing the ESAs. RTS and ITS must take the form of Regulations and are used to address technical points of implementation. They must not involve strategic decisions or policy choices.

See the "EU legislative process – Level 2" section of this topic guide for more information on the differences between delegated and implementing acts, as well as binding technical standards and the process by which Level 2 legislation is made.

The ESAs are also responsible for the production of non-binding "Level 3" guidelines and other measures to ensure consistent implementation and application of the single rulebook.

"Level 4" of the Lamfalussy Process denotes the Commission's process for checking that Member States and the competent authorities have correctly implemented and applied EU legislation. The Commission may take infringement proceedings in the Court of Justice against Member States which have not complied with their obligations under EU law. The ESAs also have a role in monitoring and advising the Commission on whether national competent authorities are correctly implementing EU law.

Publication and implementation of EU legislation

When it is adopted, all EU legislation, including delegated and implementing acts and technical standards, is published in the Official Journal of the EU in the 24 official languages of the EU. All official language versions of EU legislation are equally authentic.

Directives and Regulations enter into force on the date specified in the legislation. This is normally 20 days after publication of the legislation in the Official Journal. However:

- Regulations may contain provisions delaying the date of application of some or all of the provisions of the Regulation, in order to give affected parties time to prepare to comply with the requirements of the Regulation. The date of application may also be delayed in order to allow time for the Commission to adopt any Level 2 measures needed in order to give effect to the requirements of the Regulation or to allow the adoption of any related national rules. Although Regulations are directly applicable (and so do not require the adoption of national legislation or regulations to give effect to their provisions), Regulations will often require Member States to adopt national rules to enable national competent authorities to supervise the implementation of the Regulation and to enforce its provisions by imposing penalties or other sanctions.

- Directives will contain a "transposition deadline" which is the date by which Member States must pass national legislation or adopt national regulations to give effect to the requirements of the Directive. Directives will also specify the date (which may be the same as - or some months after - the transposition deadline) by or from which Member States will be required to apply those new laws or regulations. The date of application of the new laws may also be delayed to allow time for the Commission to adopt any Level 2 measures needed in order to give effect to the requirements of the Directive, in addition to the implementing national laws.

Better Regulation Agenda

On 15 March 2016, the Council adopted an agreement on improving EU law making. The agreement was signed on 13 April 2016 and entered into force the same day. The inter-institutional agreement is the product of a 2015 Commission Proposal to cut red tape and improve transparency, accountability and stakeholder participation in the EU legislative process. The agreement aims to improve the EU legislative process by providing that:

- each year, the Council, the Parliament and the Commission will discuss the EU's legislative priorities and agree common top priorities for the upcoming year.

- impact assessments of new initiatives will become more comprehensive by taking account a wider range of aspects, including the impact on competitiveness, in particular for small and medium-sized enterprises, the administrative burden and the cost of not taking action at EU level.

- the Council, Parliament and Commission will evaluate existing EU laws with a view to simplifying them and avoid overregulation and administrative burdens, including through an annual burden survey. This is to make sure that EU laws are fit for purpose and do not put an unnecessary burden on citizens, companies and public administrations

- a joint database on the progress of legislative files will be set up to facilitate tracking of the legislative procedure

The agreement will provide stakeholders with additional opportunities to input in all phases of the EU legislative process. Other elements of the EU's better regulation agenda comprise:

- a Communication on the creation of a New Regulatory Scrutiny Board which will replace the current Impact Assessment Board; and

- a Communication on the Regulatory Fitness and Performance (REFIT) platform bringing together high-level experts from Member States and business/civil society to discuss how to reduce regulatory and administrative burden. REFIT-driven amendments have been made to various pieces of EU legislation since inception of this initiative.

The Better Regulation Initiative also provides that after the Commission has adopted a legislative proposal there will be an eight week period after the text is submitted to Parliament and Council in all EU languages in which stakeholders can provide feedback on the proposal and the impact assessment (via the Commission's Have Your Say: Public Consultations and Feedback portal). Commission delegated and implementing acts will also be opened for public comment for four weeks before they are adopted, in parallel with a consultation of Member State experts (with limited exceptions). This will apply to delegated and implementing acts, but not technical standards.

2016 Inter-institutional agreement on better law making

Press release | Inter-institutional agreement on better law making | Better law making agreement home page

2015 Commission Proposal and Better Regulation Agenda key documents

Press release | Communication | Q&A | Guidelines and toolbox