The EU Regulation on key information documents (or KIDs) for packaged retail and insurance-based investment products (PRIIPs) (Regulation (EU) 1286/2014) introduced a new pan-European pre-contractual product disclosure document.

The PRIIPs Regulation obliges manufacturers of PRIIPs, such as fund managers, insurance companies, credit institutions and investment firms, to produce a clear concise document – the Key Information Document or KID – where such products are made available to retail investors. The PRIIPs Regulation sets out the rules for the content and format of the KID, as well as for its review and timing of delivery. In addition, any person advising on or selling a PRIIP, which may be the PRIIP manufacturer itself for direct sales or distributors and intermediaries for indirect sales, also has to comply with the PRIIPs KID regime.

PRIIPs include packaged retail investment products as well as insurance-based insurance products. The two elements of a packaged retail investment product are that (i) the returns of a PRIIP are exposed to uncertainty or fluctuations and (ii) the fact that there should be some form of packaging or indirectness.

The main objective of the PRIIPs regime is to ensure that investors are adequately informed about the characteristics of the product to enable them to make an informed investment decision and further that they are treated fairly by product distributors.

The Regulation came into force in EU member states on 29 December 2014. It applied from 1 January 2018. The final RTS on KIDs was published in the Official Journal on 12 April 2017 and entered into force on 2 May 2017.

In December 2021, transitional arrangements exempting management companies, investment companies and persons advising on, or selling, units of undertakings for collective investment in transferable securities (UCITS) and non-UCITS from the requirement to provide retail investors with a PRIIPs KID were extended to 31 December 2022 via amendments to the PRIIPs Regulation and UCITS Directive.

A Delegated Regulation, also published in December 2021, amended PRIIPs regulatory technical standards (RTS) relating to, among other things, the presentation and contents of KIDs, including methodologies for the calculation and presentation of risks, rewards and costs. These new requirements were to apply from 1 July 2022, but were delayed to 1 January 2023, in order to align the application deadline with the end of the transitional exemption.

Recent developments

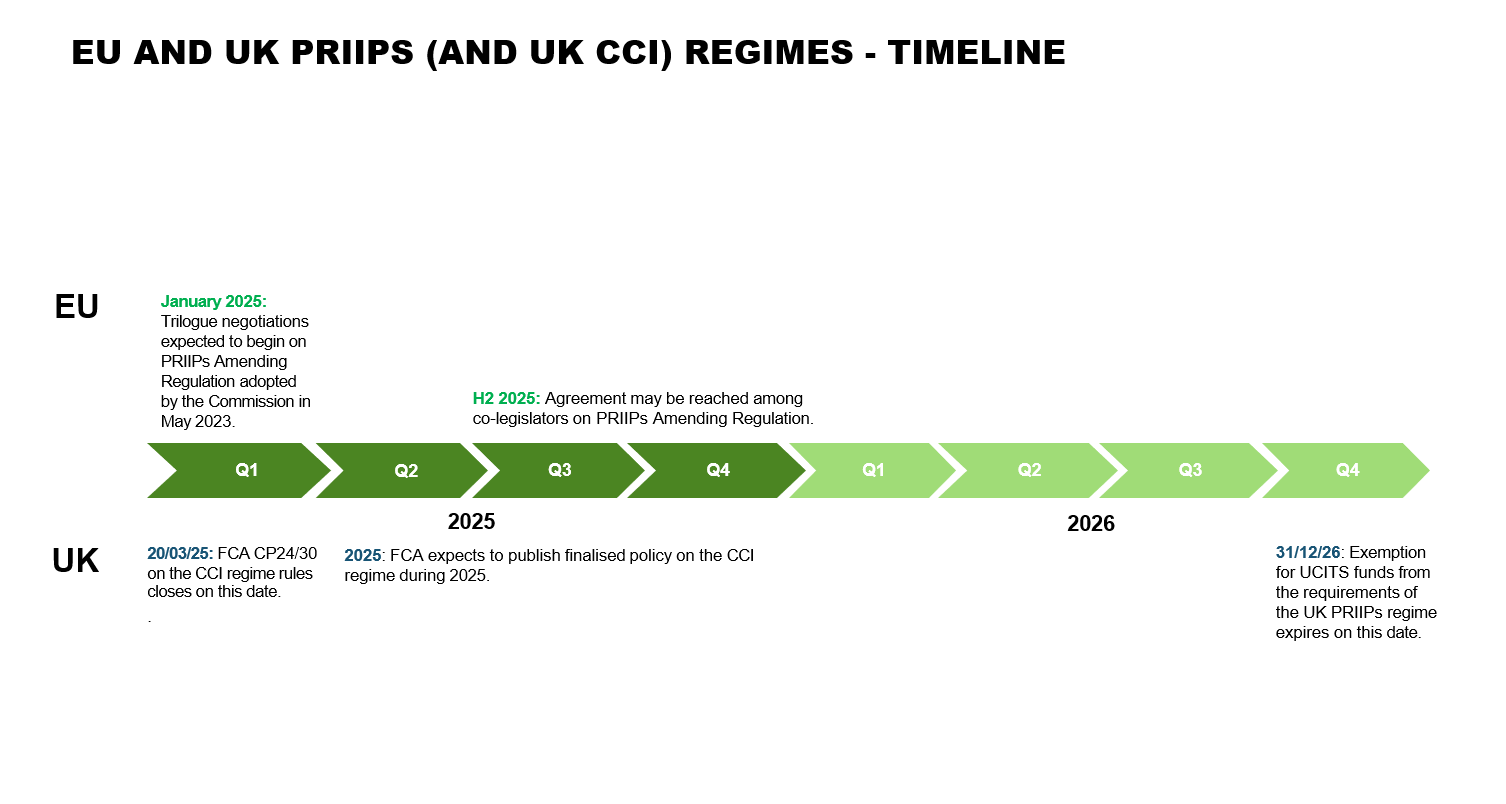

On 24 May 2023, the European Commission adopted its retail investment strategy following a review of retail investor protection rules. The legislative package includes a proposal for a regulation amending the PRIIPs Regulation making targeted changes intended to improve the coherence of disclosures and promote more transparency. The Council of the EU and the European Parliament are examining the proposal under the ordinary legislative procedure. The draft text states that the amending Regulation will apply 18 months after it enters into force, which indicates 2026 at the earliest.

Status

Level 1

The PRIIPs KID Regulation (EU) 1286/2014 applied from 1 January 2018. The application date was delayed by one year due to there being a number of significant issues with the Commission's regulatory technical standards (RTS), the detailed rules on the presentation, content and revision of the KID, which resulted in the Parliament rejecting them in September 2016. Revised RTS were subsequently adopted and Delegated Regulation (EU) 2017/653 entered into force in May 2017 and applied from 1 January 2018.

Level 2

A number of Level 2 measures were required by the PRIIPs Regulation

In addition, the Commission could have adopted delegated acts specifying the details of the procedures used to establish whether a PRIIP targets specific environmental or social objectives. However, in Joint Technical Advice issued in July 2017, the ESAs concluded that it would not be proportionate to establish specific and detailed standalone obligations for PRIIPs that target specific environmental or social objectives and that existing measures are sufficiently stringent.

Level 3

Guidance on the application of PRIIPs has been issued by the Commission and the ESAs.

In July 2017, the Commission adopted a communication containing guidelines on the application of PRIIPs.

The Joint Committee of the ESAs (EBA, ESMA and EIOPA) have issued Q&As on the KID, which are periodically updated, and are intended to promote supervisory convergence on the contents of the KID. On 6 December 2023, the most recent version of the consolidated Q&As were published.

Due to the cross-over between MiFID2 and PRIIPs in a number of key areas, Guidance issued in relation to MiFID2/MiFIR may be relevant. Further information is available on the MiFID2 Topic Guide. In addition, PRIIPs crosses over into the Insurance Distribution Directive (IDD). Guidance from the European Insurance and Occupational Pensions Authority (EIOPA) is available on the EIOPA website.

Application

- 1 January 2018: Regulation and RTS applied

- 31 December 2022: end of transitional arrangement whereby management companies, investment companies and persons advising on, or selling, units of UCITS and non-UCITS were temporarily exempted from the requirement to provide retail investors with a key information document

- 1 January 2023: amendments introduced by Delegated Regulation (EU) 2021/2268 (as amended) to the RTS set out in Delegated Regulation (EU) 2017/653 (as amended) applied

Next

- Timing uncertain: (earliest 2026): on 24 May 2023, the European Commission adopted its retail investment strategy, including revised retail investor protection rules contained under, among other things, the PRIIPs Regulation. The Council of the EU and the European Parliament are examining the proposals under the ordinary legislative procedure.

![]()